montana sales tax rate 2019

Start a trial Contact sales. And Friday 900 am.

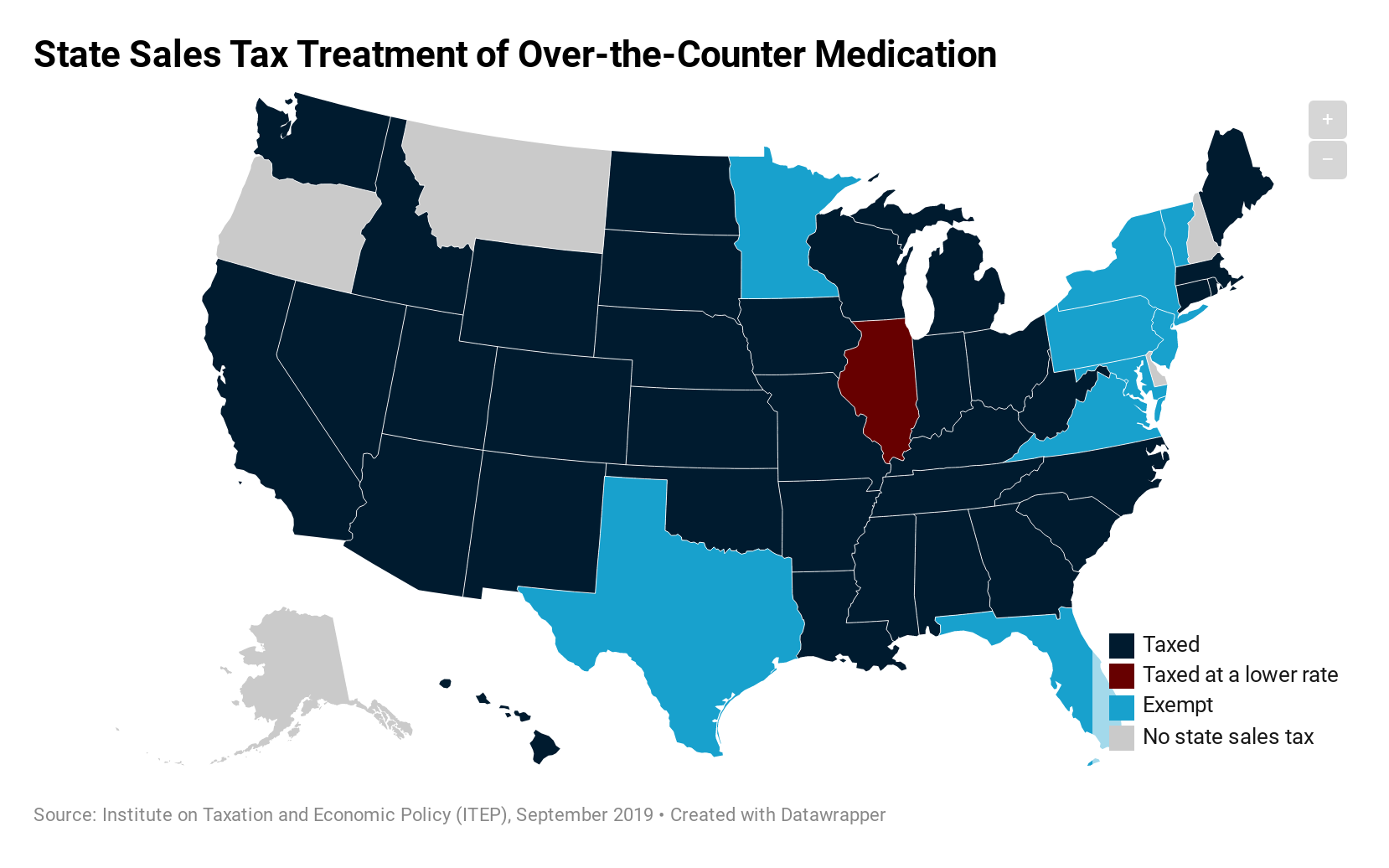

How Do State Tax Sales Of Over The Counter Medication Itep

5400 2 of taxable income.

. 3100 1 of taxable income. Start managing your sales tax today. Tax rate of 1 on the first 3100 of taxable income.

The credit is equal to 2 of all net capital gains listed on your Montana income tax return. Montana charges no sales tax on purchases made in the state. Montana MT Sales Tax Rates by City.

The local option sales tax rate would be determined by the local government with voters then deciding on the proposal. Sales and Use Tax 2019 Statistics. Did South Dakota v.

The Montana State Sales Tax is collected by the merchant on all qualifying sales made within Montana State. The bill opens the door with a 25 tax that will go into effect on January 1 2020. TAX RATES Chargeable Income From To Rate Subtract.

The Montana MT state sales tax rate is currently 0. There are no local taxes beyond the state rate. Montana is one of the five states that have no sales tax.

The state sales tax rate in Montana is 0 but you can. Below are forms for prior Tax Years starting with 2020. Tax rate of 4 on taxable income between 8201 and 11100.

Montana Income Tax Forms. The combined sale tax rate is 0. Method to calculate Montana sales tax in 2021.

7 MO13 1 AR 93 3 LA 9. The sales and use tax amounts include the 6875 general rate sales and use 4469 mobile home 65 in-lieu lottery additional 25 liquor and additional 92 car rental taxes. By City and Industry.

Automate sales tax calculations reporting and filing today to save time and reduce errors. Montana ranks relatively high on its use of. For married taxpayers living and working in the state of Montana.

Check the 2019 Montana state tax rate and the rules to calculate state income tax 5. 368 rows There are a total of 73 local tax jurisdictions across the state collecting an average. A6 1 NC 69 2 SC3 GA 129 19 FL0 22 AL 91 5 S0 21 TN 9.

In effect that lowers the top capital gains tax rate in Montana from 69 to 49. If the local option sales tax were to pass it would be enacted for 10 years unless residents vote to repeal it during that time. If you need help working with the department or figuring out our audit appeals or relief processes the Taxpayer Advocate can help.

Get a quick rate range. The 2018 United States Supreme Court decision in South Dakota v. Tax rate of 2 on taxable income between 3101 and 5400.

The cities and counties in Montana also do not charge sales tax on general purchases so the state enjoys tax free shopping. 2019 Montana Individual Income Tax Rates. Effective tax rates are property taxes divid- ed by the market value of the property.

Montana has no state sales tax and allows local governments to collect a local option sales tax of up to NA. The motor vehicle sales tax amounts are not included. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a states tax system.

Details on how to only prepare and print a Montana 2021 Tax Return. Lawmakers must understand that they cannot resolve the unfairness of sales taxes simply by offering a short break from paying these taxes. Table 2Effective Property Tax RatesResidential Property.

There is no local add-on tax. 1 Special taxes in Montanas resort areas are not included in our analysis. 2022 Montana Sales Tax Table.

While the base rate applies statewide its only a starting point for calculating sales tax in Montana. Goods and services can be purchased sales-tax-free though sin taxes on alcohol and cigarettes do apply. The state sales tax rate in Montana is 0000.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Were available Monday through Thursday 900 am. Montana Individual Income Tax.

Has impacted many state nexus laws and sales tax. But not more than Then your tax rate is. The County sales tax rate is.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. The Montana sales tax rate is currently. Montana State Income Tax Forms for Tax Year 2021 Jan.

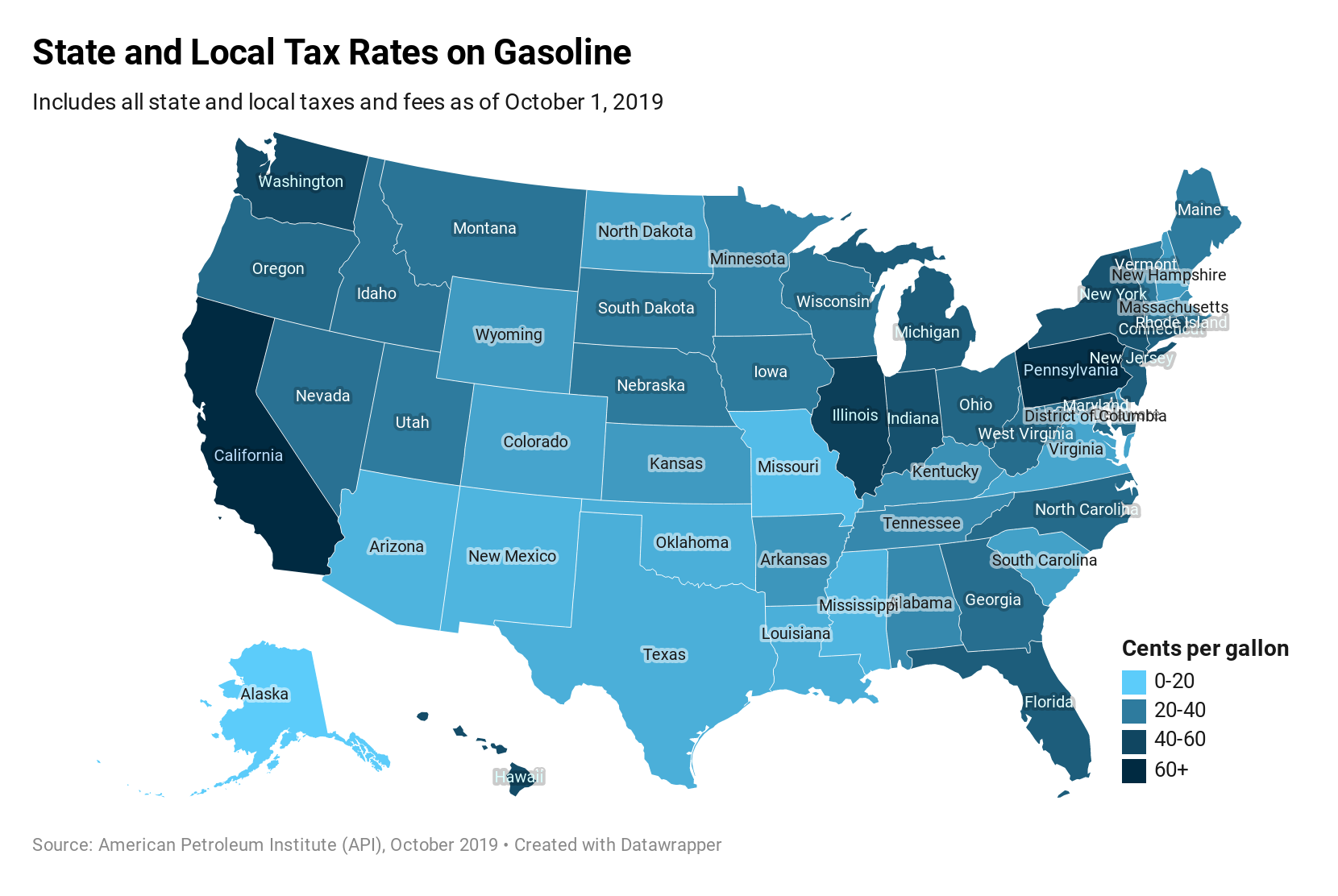

2019 Sales Taxes Montana has no general sales tax but levies selective excise taxes on gasoline alcohol tobacco lodgings and other items. Wayfair Inc affect Montana. This is the total of state county and city sales tax rates.

If your taxable income Form 2 page 1 line 14 is. Base state sales tax rate 0. Some locations Montana such as Whitefish charge tax on lodging.

The tax rate is 216 percent for 2018. For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. 1 K 600 3 OH1 20 IN00 23 IL.

8200 3 of taxable income. The Malta sales tax rate is. 11100 4 of taxable income.

Tax rate of 69 on taxable income over 18400. Some rates might be different in Montana State. These back taxes forms can not longer be e-Filed.

Montana state sales tax rate. If the long-term consequence of sales tax holidays is a higher sales tax rate. State and Local Sales Tax Rates January 2019 Key Findings Forty-five states and the District of Columbia collect statewide sales taxes.

Tax rate of 3 on taxable income between 5401 and 8200. It would not exceed 4 similar to the 2019-approved resort tax rates for Montana. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

There is no state sales tax in Montana. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Montanas sales tax rates for commonly exempted categories are listed below.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

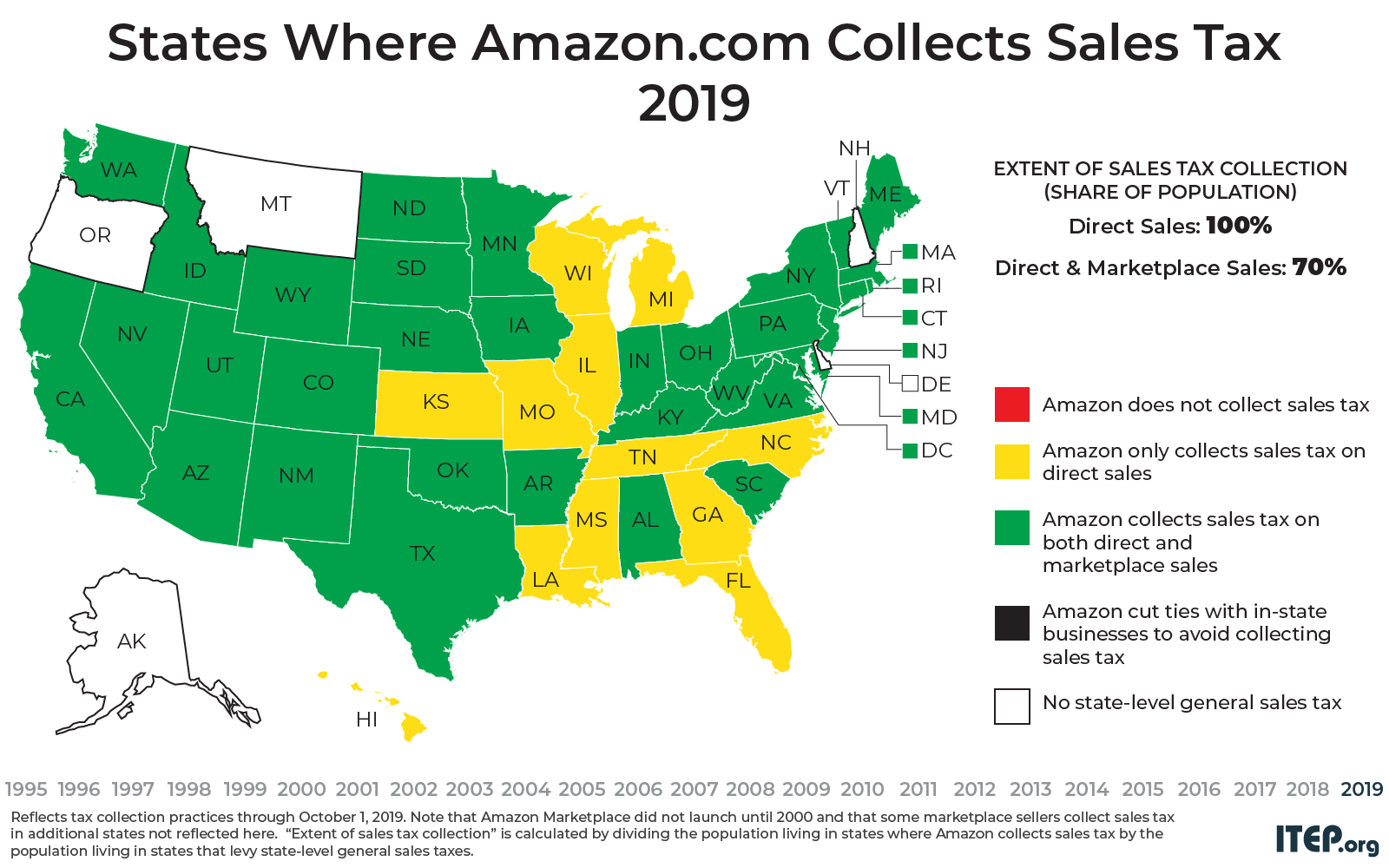

Amazon Sales Tax A Compliance Guide For Sellers Sellics

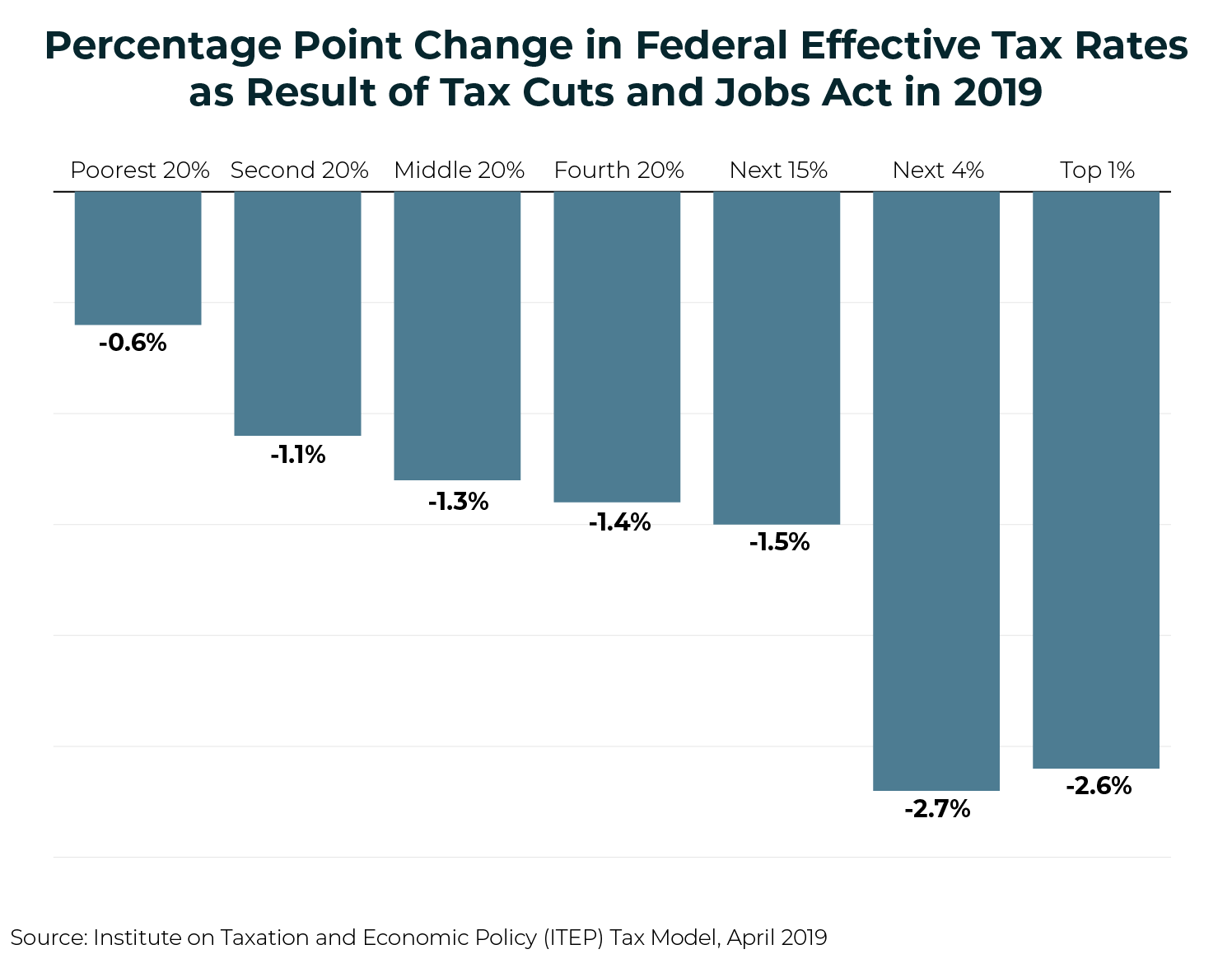

Who Pays Taxes In America In 2019 Itep

States Without Sales Tax Article

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Taxes Fees Montana Department Of Revenue

How Do State And Local Sales Taxes Work Tax Policy Center

Montana State Taxes Tax Types In Montana Income Property Corporate

States Without Sales Tax Article

U S Sales Taxes By State 2020 U S Tax Vatglobal

Salestaxhandbook The Comprehensive Sales Tax Guide

States With Highest And Lowest Sales Tax Rates

Montana State Taxes Tax Types In Montana Income Property Corporate

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)